If you’re looking to boost your financial skills for 2025, I recommend exploring top books covering accounting software like QuickBooks Pro 2024, Sage 50, and Xero for Dummies. These resources offer practical tips, user-friendly guides, and insights into managing small business finances effectively. They’ll help you understand essential concepts and tools to keep your finances on track. Keep exploring, and you’ll discover more strategies to master your accounting skills.

Key Takeaways

- Focus on books that explain accounting software features, functionalities, and practical applications for small businesses and beginners.

- Prioritize titles that include visual aids, tutorials, and real-world case studies to enhance understanding.

- Select books covering regional accounting standards, tax laws, and industry-specific processes relevant for 2025.

- Look for guides that incorporate digital tools, automation, and latest software updates to stay current.

- Consider resources that combine theoretical concepts with hands-on exercises to improve practical financial skills.

QBDT Pro 2024 Software License for 3 Users

If you’re looking for a reliable accounting software for a small team, the QBDT Pro 2024 Software License for 3 users is an excellent choice. It’s a lifetime license, available as a digital download via Amazon, with delivery within 12 hours. The license is from a third-party retailer, so validation by QuickBooks isn’t possible anymore, but the codes are original and valid for life. Keep in mind, support is limited, and some features like payroll are unavailable. You’ll need to handle bank feeds and migration manually. Make sure to verify the seller’s reviews and message before purchasing to avoid scams.

Best For: small teams or small business owners seeking a cost-effective, lifetime accounting software with manual features and limited support.

Pros:

- Lifetime license with no recurring fees or subscriptions

- Digital delivery within 12 hours via Amazon Message

- Original, valid license codes for lifelong use

Cons:

- Limited support; no official QuickBooks support available

- Features like payroll are unavailable; bank feeds require manual import

- Validation by QuickBooks is no longer possible for unactivated licenses

Bookkeeper: Easily Manage Your Business Finances

Bookkeeper is an excellent choice for small business owners who want a straightforward way to manage their finances efficiently. It simplifies tracking income and expenses, with features like printing to blank check stock and customizable check layouts. The software also supports electronic filing for tax forms such as W-2, 1099-NEC, and 1099-MISC through a third-party service, with an additional fee. Plus, it now supports the new 1099-NEC form, ensuring you’re up-to-date with tax requirements. Overall, Bookkeeper offers essential tools to keep your finances organized and compliant, making daily bookkeeping tasks easier and more manageable.

Best For: small business owners seeking an easy-to-use solution for managing finances, tracking expenses, and filing taxes electronically.

Pros:

- Simplifies tracking income and expenses for small businesses

- Supports printing to blank check stock with customizable check layouts

- Facilitates electronic filing of tax forms like W-2, 1099-NEC, and 1099-MISC through third-party services

Cons:

- Check layout customization options are limited and not available within the software

- Additional fee required for electronic tax filing services

- No mention of integration with other accounting or financial tools

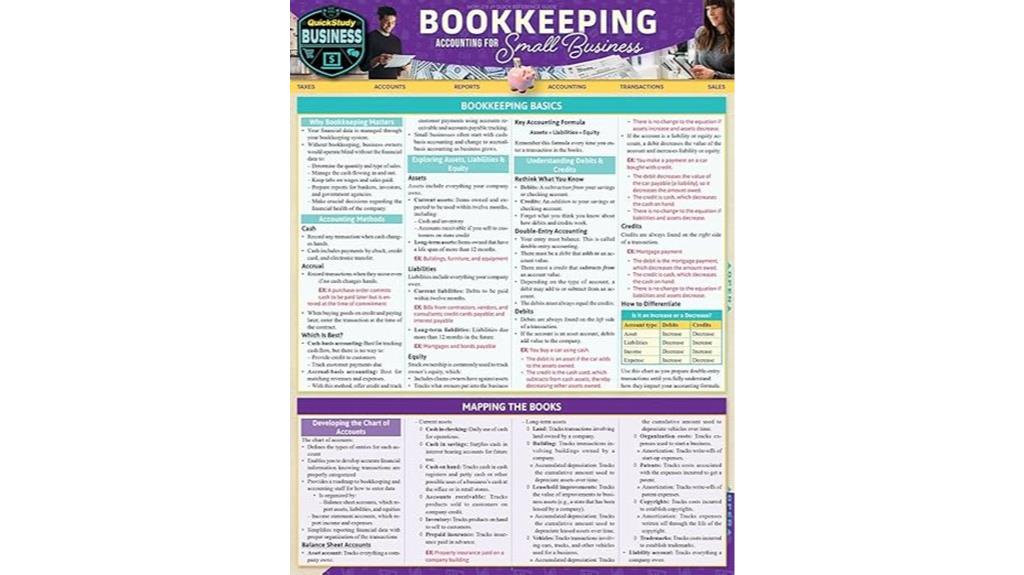

Bookkeeping and Accounting for Small Business Quickstudy Laminated Guide

The Bookkeeping and Accounting for Small Business Quickstudy Laminated Guide is an ideal resource for small business owners, students, and professionals seeking a quick, reliable reference. Its laminated design makes it durable and easy to use at your desk, offering all-encompassing yet simplified information on essential bookkeeping and accounting topics. I find it especially helpful as a handy “cheat sheet” or refresher, whether I’m managing daily tasks or reviewing concepts. The guide covers fundamental principles, transaction handling, and basic accounting, making it perfect for beginners and experienced accountants alike. It’s affordable, well-organized, and boosts confidence in handling financial tasks efficiently.

Best For: small business owners, students, and professionals seeking a quick, reliable, and comprehensive accounting reference for daily use or study.

Pros:

- Durable laminated design for long-lasting desk use

- Simplified, comprehensive coverage of essential bookkeeping and accounting topics

- Easy to navigate and well-organized, making quick reference effortless

Cons:

- Could benefit from more space between sections for easier identification

- May lack detailed explanations for advanced accounting topics

- Limited customization options due to the laminated, fixed layout

Accounting for Small Business Owners

This guide is ideal for small business owners who want a straightforward introduction to accounting fundamentals. I find it helpful because it covers essential topics like income statements, balance sheets, cash flow, taxes, and wages in simple terms. The book uses visual aids like charts and tables, making complex ideas easier to grasp, especially for visual learners. It walks you through setting up your business finances, managing daily operations, and understanding industry regulations. Whether you’re starting out or looking to improve your financial skills, this resource clarifies accounting principles and business structures, making it a practical tool for small business success in 2025.

Best For: small business owners and entrepreneurs seeking a clear, visual introduction to accounting fundamentals to manage finances effectively.

Pros:

- Uses visual aids like charts and tables to simplify complex concepts.

- Covers essential topics such as income statements, balance sheets, cash flow, taxes, and wages.

- Suitable for beginners with straightforward, easy-to-understand explanations.

Cons:

- The Kindle version may lack some notes and have charts that are too small to read comfortably.

- It is basic and may not cover advanced accounting topics in depth.

- Less useful for international or non-US business contexts.

Sage 50 Pro Accounting 2024 U.S. Subscription Software

Sage 50 Pro Accounting 2024 U.S. is a trusted choice for small businesses, supporting them for over 42 years. It offers reliable, user-friendly features with a simple setup process. You can customize reports in real-time and manage finances efficiently—pay bills, invoice clients, and track costs with ease. The software’s job costing tools help you assess profitability, while inventory management keeps stock levels accurate. Plus, the included Sage Business Care plan provides online support, ensuring you’re never alone when steering your financial tasks. Overall, it’s a comprehensive solution designed to streamline your accounting and boost your business growth.

Best For: Small businesses seeking reliable, user-friendly accounting software with comprehensive financial management and support.

Pros:

- Trusted support and reliability with over 42 years of experience

- Easy setup with customizable reports and real-time data management

- Efficient tools for invoicing, bill payments, job costing, and inventory control

Cons:

- Subscription-based model may incur ongoing costs

- Limited advanced features for larger or more complex businesses

- May require some basic accounting knowledge for optimal use

Basic Income and Expense Tracker (Excel based)

Small business owners seeking an easy, customizable way to track their income and expenses will find the Basic Income and Expense Tracker (Excel-based) an ideal solution. This user-friendly spreadsheet lets you input monthly income and expenses across 21 categories and 8 income types, with automatic calculations and visual reports. It’s simple to modify, even without advanced Excel skills, making it perfect for personalized tracking. While it doesn’t offer bill reminders or due date alerts, it streamlines receipt management and tax prep. Many users appreciate its affordability and ease, especially compared to complex accounting software. It’s a practical tool for small businesses focused on straightforward financial monitoring.

Best For: small business owners seeking an easy-to-use, customizable Excel-based tool for straightforward income and expense tracking without the need for advanced accounting features.

Pros:

- User-friendly interface that requires no advanced Excel skills to modify or operate

- Customizable categories for income and expenses to suit specific business needs

- Automatic calculations and visual reports simplify financial review and tax preparation

Cons:

- Does not include bill reminders or due date alerts, limiting its use for managing payment schedules

- Not suitable for comprehensive financial management or detailed accounting functions

- Basic features may require supplementary tools for more complex financial tracking

Using Microsoft Excel and Access 2016 for Accounting

If you’re a college student taking a course that requires mastering Microsoft Excel and Access 2016 for accounting, this book can serve as a useful reference, especially if you’re already familiar with basic accounting concepts. However, I found it hard to follow due to complicated examples and unclear explanations. Many practice problems felt unrelated to chapter topics, making it tough to apply what I learned. Despite the book being in good condition and as advertised, I often had to rely on YouTube tutorials for clarity. Overall, I’d recommend supplementing this book with online tutorials for better understanding and practical skills.

Best For: college students who need a reference guide for using Microsoft Excel and Access 2016 specifically for accounting purposes.

Pros:

- Good physical condition and as advertised

- Useful as a supplementary reference for accounting software

- Covers essential features of Excel and Access 2016

Cons:

- Difficult to follow due to complicated examples and unclear explanations

- Practice problems are often unrelated to chapter content, reducing practical usefulness

- Lacks downloadable files or additional online resources to enhance learning

The Joy of Accounting: A Game-Changing Approach That Makes Accounting Easy

Are you seeking an accessible way to grasp fundamental accounting concepts without getting bogged down in technical jargon? I found that *The Joy of Accounting* offers a game-changing approach that makes learning easy and intuitive. Developed from over a decade of teaching diverse learners, it emphasizes understanding money flow, risks, and opportunities through visual and systematic explanations. The color-coding system simplifies debits and credits, making concepts memorable. Its focus on ideas over rigid definitions, along with real-world case studies, helps build confidence and clarity. This approach demystifies accounting, making it perfect for students, entrepreneurs, and anyone enthusiastic to understand business finances effortlessly.

Best For: learners seeking an intuitive, visual, and concept-driven approach to understanding accounting concepts without prior technical knowledge.

Pros:

- Simplifies complex accounting ideas through visual explanations and color-coding for easy memorization

- Suitable for a wide audience, including students, entrepreneurs, and non-finance professionals

- Emphasizes understanding of money flow, risks, and opportunities, building confidence in financial decision-making

Cons:

- Limited focus on cash flow statements and less detailed analysis of cash flow management

- Lacks extensive exercises or practical problems for skill reinforcement

- Some users may find the initial emphasis on ideas over formal definitions challenging for advanced learning

Express Accounts Accounting Software Free [PC Download]

Looking for a reliable accounting solution that’s easy to access and manage? I recommend Express Accounts Accounting Software Free [PC Download]. It allows you to connect securely via web, making it simple to monitor your finances from anywhere. You can handle payments, check account balances, and generate detailed financial reports effortlessly. The software also lets you create and track quotes, invoices, and related documents, helping streamline your billing process. Plus, you can email or fax reports directly to your accountant, saving time. It’s a practical, user-friendly tool for small businesses seeking free, efficient financial management with essential features.

Best For: small business owners seeking a free, easy-to-use accounting software with remote access and essential financial management features.

Pros:

- Secure web access allows for flexible management from anywhere

- Includes tools for invoicing, quotes, and financial reporting to streamline business processes

- Facilitates direct email and fax sharing of reports with accountants

Cons:

- May lack advanced accounting features needed for larger or more complex businesses

- Limited customization options compared to paid software solutions

- Free version might have restrictions on some functionalities or support

Xero For Dummies

Curious about a straightforward introduction to Xero’s features? I found *Xero For Dummies* helpful for beginners, offering a clear overview of the core functions. It explains Xero’s basics well, but I noticed it’s limited when it comes to advanced topics like payroll and regional specifics. The book mainly focuses on American terminology, which might be confusing for international users. While it’s a good starting point, it doesn’t cover everything—especially complex features—making it less ideal for those needing in-depth guidance. Still, if you’re new to Xero, this book can help you get up and running quickly.

Best For: Beginners seeking a straightforward, easy-to-understand introduction to Xero’s core features, especially those primarily using American terminology.

Pros:

- Provides a clear and comprehensive overview of Xero’s basic functions.

- Well-written and accessible for new users.

- Useful as a starting point to get up and running quickly.

Cons:

- Lacks in-depth coverage of advanced features like payroll and regional specifics.

- Focuses mainly on American terminology, limiting international applicability.

- Omits detailed guidance on complex topics, reducing usefulness for experienced users.

Factors to Consider When Choosing Accounting Software Books

When selecting accounting software books, I focus on how well they cover essential topics and match my skill level. I also consider how easy they are to follow and whether they include helpful visual aids or diagrams. Most importantly, I look for books that offer practical applications to reinforce what I learn.

Content Depth and Coverage

How thoroughly a book covers fundamental accounting principles can considerably impact your ability to master the software. I look for books that offer extensive explanations of core topics like journal entries, financial statements, and bookkeeping processes, ensuring I grasp the essentials. Practical examples, case studies, and step-by-step guides are invaluable, helping me connect theory to real-world tasks. I also check whether the content includes specialized areas like payroll, tax reporting, inventory management, or cash flow analysis, especially if I manage a business with specific needs. While some books focus on basic concepts suitable for beginners, others explore in-depth topics for more experienced users. I want a book that matches my current expertise and business requirements, providing the right depth without overwhelming me.

User-Friendliness Level

Choosing an accounting software book that’s user-friendly can make a significant difference in how quickly and effectively I learn. I look for books with clear language, visual aids, and step-by-step instructions that simplify complex concepts. Practical examples and case studies help me connect theory to real-world situations, making the material more relatable. A simplified layout with organized chapters and concise summaries allows me to navigate easily and find information fast. For beginners, it’s important that the book avoids technical jargon and complicated terminology, ensuring accessibility. Additionally, supplementary resources like tutorials, quick reference guides, or review questions boost my understanding and retention. Overall, a user-friendly book makes the learning process smoother, more engaging, and less intimidating.

Relevance to Needs

Ever wondered if a particular accounting software book truly meets your specific needs? To determine that, I look for books that cover features and concepts relevant to my business size and industry. I focus on resources that address the tasks I perform most often, like payroll, inventory, or tax filing. It’s also essential that the level of detail matches my current knowledge—whether I’m a beginner or seeking advanced insights. Since regulations vary by jurisdiction, I ensure the book aligns with local accounting standards, especially if I’m working internationally. Finally, I prefer practical guides with real-world examples applicable to my chosen software. This approach helps me find resources that are truly relevant, making my learning efficient and directly applicable to my financial management needs.

Visual Aids and Diagrams

When evaluating accounting software books, I pay close attention to the quality and usefulness of visual aids like diagrams, charts, and color-coded illustrations. Well-designed visuals can make complex concepts much easier to understand, especially for beginners. Diagrams that show transaction flows or the accounting equation help clarify how different financial elements connect. Color-coded visuals serve as quick references, reducing mental effort when recalling processes. They also aid retention by providing visual storytelling that makes abstract ideas more concrete. For me, clear and labeled visuals enhance comprehension and make learning more engaging. Especially for visual learners, these aids transform dense information into accessible, memorable insights. Overall, effective visual aids are essential for grasping the intricacies of accounting software.

Application and Practice

How can you guarantee that an accounting software book truly prepares you to use the tools effectively? Focus on books that emphasize practical application. Look for ones that include transaction recording, report generation, and data entry exercises. Hands-on practice through case studies and real-world examples helps bridge theory and practice, making concepts more tangible. Step-by-step tutorials on complex processes like payroll, inventory, and bank reconciliations are vital for building confidence. Additionally, customizable templates, reports, and visual aids are useful for applying skills to actual business scenarios. Clear instructions on setting up and steering specific software functionalities ensure you can confidently operate the tools. Ultimately, the best books blend theory with applied practice, so you’re ready to implement what you learn in real-world situations.

Regional and Industry Focus

Choosing the right accounting software book goes beyond practical exercises; it also requires ensuring the content aligns with your specific regional and industry needs. I look for books that cover local accounting standards, tax laws, and regulations relevant to my country or jurisdiction to stay compliant. Industry-specific books are especially valuable because they address unique financial processes and reporting requirements, whether for retail, construction, or other sectors. I also check if the material includes regional terminology, currency handling, and compliance procedures, making it more practical. For my industry, I prefer books that offer guidance on local reporting formats and legal requirements, ensuring I don’t miss critical compliance steps. Tailoring my reading to these factors helps me apply lessons more effectively in my business environment.

Frequently Asked Questions

How Do Accounting Books Adapt to Evolving Financial Regulations in 2025?

I find that accounting books adapt to evolving financial regulations by regularly updating their content to reflect new laws and standards. Authors collaborate with experts and review recent changes to guarantee accuracy. As a reader, I stay informed by choosing books that mention recent updates and revisions. This way, I can confidently apply current regulations, knowing my financial practices are compliant with the latest rules in 2025.

Are There Specific Books Tailored for Small Versus Large Business Accounting Needs?

I find that many accounting books are tailored to different business sizes. For small businesses, I recommend books focusing on simplicity, cash flow management, and basic bookkeeping. Large businesses need more complex texts covering consolidated financial statements and regulatory compliance. When choosing a book, I look for one that matches my business scale and industry needs, ensuring it provides practical, applicable advice to keep my financial skills sharp and relevant.

Which Books Offer Practical, Real-World Case Studies for Better Understanding?

Did you know that real-world case studies can transform your understanding of accounting? I’ve found books like “Financial Intelligence” and “Accounting Made Simple” truly helpful because they include practical examples. These stories help me see how concepts apply in everyday business situations. If you’re looking to deepen your practical understanding, I highly recommend books that blend theory with real case studies—they make learning engaging and applicable.

How Do Accounting Books Incorporate Emerging Technologies Like AI and Automation?

I find that accounting books now incorporate emerging technologies like AI and automation by including real-world examples and case studies. They explain how these tools streamline processes, improve accuracy, and save time. Many books also feature step-by-step guides on implementing these technologies, making it easier for readers to understand their practical applications. This integration keeps accounting professionals updated and prepares us for the evolving financial landscape.

Can These Books Help Improve Overall Financial Decision-Making Skills?

It’s funny how the right books can unexpectedly transform your financial decision-making. I’ve found that accounting books, especially those focusing on software and modern techniques, sharpen my skills by revealing patterns and insights I hadn’t noticed before. They teach me to analyze data better, weigh options more confidently, and stay ahead of financial trends. So, yes, these books truly help improve overall decision-making—by making complex concepts clearer and more actionable.

Conclusion

By exploring these top accounting books, I’ve realized that mastering financial tools isn’t just about software; it’s about understanding the principles behind them. I believe that combining practical guides with a solid grasp of accounting theory can truly elevate your skills. Think of it like investing in knowledge; the more you understand, the more confidently you can navigate your financial future—proving that education is the real key to success in this field.